Last May, the International Energy Agency (IEA) published a review of Finland’s current state of energy policies. Naturally, we at YES-Europe Finland were particularly interested in this and together we decided to condense the content of the report into a slightly smaller form, as well as highlight interesting observations and results from the IEA’s review. The IEA typically publishes energy policy reviews of its member countries every five years, with the previous report of Finland being released in 2018. These reviews offer important external perspectives of the energy strategies along with international collaboration and policy guidance.

Even though changes in the energy industry usually require a lot of time and effort, the last five years have shown that a lot can happen globally as well as in Finland. Especially, events during the last two years have brought irreversible changes to the Finnish energy sector and its future prospects. Finland’s rapid reduction in the import of Russian fossil fuels, the deployment of a new nuclear reactor, and strong growth in wind generation, just to mention a few examples. In addition to the examples of the report, it should be mentioned that Finland also finally published its own hydrogen strategy. (H2cluster, 2023)

IEA recognizes the development in the review and Finland’s progress to achieve carbon neutrality. Despite some challenges, the world’s most ambitious climate targets were committed even stronger than before by creating a legal obligation to reach carbon neutrality by 2035. IEA’s almost 200 page review is divided into three sections: Energy insights, Energy system transformation and Energy security. The first two sections contain many of the same topics, so we condensed them into one. Let’s take a look at what it consists of.

Energy Insights

Finland, known as the “Land of a Thousand Lakes”, boasts a vast land area primarily adorned by lakes and forests. It holds the distinction of being the most forested country in Europe (World Bank Open Data). Finland has one of the highest per capita energy demands in the world due to the cold climate, well-developed economy and a robust industrial sector.

Renewable energy produces the majority of energy

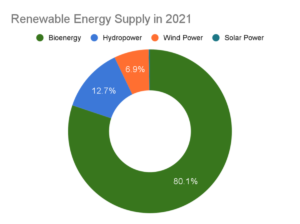

Finland has made impressive strides in reducing its reliance on fossil fuels by leveraging nuclear power and expanding renewable energy production. Renewable energy has been on the rise in Finland; renewable energy accounts for 50.76% of total final energy consumption where bioenergy, hydropower and wind power were the major renewable production methods.

As a result, the share of fossil fuels in the total energy supply dropped to 36%, which is significantly lower than the IEA average of 70%. The share of nuclear energy in electricity generation is also expected to increase significantly with the operation of the new Olkiluoto 3 reactor.

Finland’s policy documents indicate that renewable energy needed to meet 2035 climate neutrality will mainly come from biomass and wind power. According to the IEA, the government sees low-emission hydrogen and hydrogen-derived fuels as better solutions than direct electrification for aviation, maritime and heavy road transport. However, this is still controversial, as the hydrogen economy is yet to develop.

The Finnish government sees innovation in energy technology as a key part of achieving the 2035 carbon neutrality target. Companies are encouraged to renew and create sustainable and competitive business with exportation of clean technologies. Moreover, actively engaging with international partners and organizations could foster collaboration on clean energy technologies, research, and innovation.

Energy efficiency efforts are conflicting with emission reduction targets

Finland’s energy demand has fluctuated between 1 007 PJ and 1 114 PJ between 2005 and 2021, most of which is consumed by the industrial sector. Finland has achieved its 2020 energy efficiency targets for primary energy consumption (PEC) and final energy consumption (FEC). Current energy efficiency targets for 2030 are not aligned with GHG emission reduction targets that were recently increased from 40 % to 55 %. If Finland is to reach GHG emissions reduction and energy efficiency targets, Finland needs to reduce PEC and FEC to 1296 and 900 PJ respectively instead of the current targets of 1458 and 1044 PJ.

Emissions

Notably, Finland also made progress in reducing fossil fuel demand for final consumption. In terms of sectors, Finland’s industry sector dominates total final consumption and utilizes a diverse mix of energy sources. The transport sector heavily relies on oil, although the adoption of electric vehicles (EVs) is noteworthy, representing 31% of new vehicle sales in the last year.

Furthermore, Finland’s electricity generation has one of the lowest carbon intensities among IEA countries, emitting 101 g CO2/kWh in 2021 compared to the IEA average of 321 g CO2/kWh. However, it is important to note that the country has experienced a declining trend in carbon removal from Land Use, Land-Use Change, and Forestry (LULUCF) since 2010. As a result, the land-use sector has become a net source of greenhouse gas emissions for the first time in 2021.

Finland is committed to achieving carbon neutrality by 2035, focusing on energy security, reduced import reliance, sustainable economic growth, and biodiversity preservation. The updated Climate Change Act, implemented in July 2022, legally binds Finland to attain carbon neutrality by 2035, with specific emission reduction targets of 60% by 2030, 80% by 2040, and 90-95% by 2050 (Ilmastolaki).

Greenhouse gas emissions from energy production have decreased from 56.1 Mt CO2-eq to 37.6 Mt2-eq. This reduction in GHG emissions has been driven by a strong reduction in use of carbon intensive fuels such as coal, natural gas and peat and increased usage of wind and electricity imports.

Finland needs to increase carbon removal from land use from 17 Mt CO2-eq to 21 Mt CO2-eq by 2035 to meet its goals. Finland’s biomass demand given in road maps doesn’t support these goals and the Finnish government should develop clear quantitative estimates for the level of logging that is allowed while achieving the required amount of carbon capture from LULUCF.

COVID and Russia

Finland has received EUR 2.1 billion in funding from the EU to aid its recovery from the COVID-19 pandemic. The approved plan focuses on green transition, with projects related to renewable energy, energy infrastructure, low-emission hydrogen, carbon capture storage, and EV charging points (European Commission).

To mitigate the impact of increasing energy prices, Finland has implemented measures such as reducing retail electricity prices, limiting profits for distribution system operators, exploring energy transition investment programs, and preparing a loan guarantee program to support energy efficiency and renewable heating systems (Fortum 2022).

The 2023 budget proposal also includes measures to assist low-income families in coping with high electricity and heating costs through tax credits and financial support schemes. In response to the Russian invasion of Ukraine, Finland and the EU are actively working to decrease their dependence on Russian energy imports. Historically, Finland has heavily relied on Russian imports for various energy sources, but Russia halted supplies following the invasion (Ministry of Economic Affairs and Employment 2022). The EU has imposed sanctions on Russian coal and petroleum imports, while Finland is seeking alternative energy sources and securing gas imports through a floating storage and regasification terminal.

Awakening the Hydrogen Economy

Finland’s National Hydrogen Roadmap focuses on developing a domestic hydrogen value chain, expanding electrolysis capacity, and implementing support programs for hydrogen projects, and international collaboration (Business Finland 2020). Finland recognizes the potential for economic growth and a secure energy transition in critical mineral mining and the battery supply chain, leveraging its abundant deposits of cobalt, nickel, lithium, graphite, and other crucial minerals, with Finnish companies expanding production and refining a significant portion of global cobalt output. As mentioned, the hydrogen strategy published in June 2023 points the way towards a hydrogen economy in Finland.

Energy Security

The last 5 years have made energy security a big theme in the national energy debate, mostly due to the Russian invasion of Ukraine but also some natural development in the energy sector. The section on Energy Security on the Energy Policy Review is split into 4 categories: Electricity, Nuclear, Natural gas and Oil. From the perspective of energy security, major changes have happened in all of the sectors.

A major part of the development has been centered around Finland detaching from its dependence on Russia, whether it be imported electricity, natural gas, or oil imports. The overall trend is clear: with the help of nuclear power, renewable energy and electrification Finland is set to be more and more energy independent in the upcoming decades. Below is a summary of the main points of each category of the Energy Security-section of the Energy Policy Review. (IEA 2023)

- Finland is a net importer of electricity, importing about 18-24 TWh of electricity per year during 2018-2022. Thanks to the start of the nuclear reactor Olkiluoto 3 and increasing capacity of renewable generation, Finland´s electricity imports are expected to decrease significantly.

- Electricity exports from Russia stopped in May 2022, after the Finnish announcement to join NATO. To ensure availability of electricity Finland launched a national energy saving campaign in August 2022. Down a Degree -campaign managed to reduce quarterly electricity consumption significantly, about 2.4 TWh in the fourth quarter of 2022.

- Even though electrification is considered an important part of future development in Finland, in the last decade there has been almost no increase in electrification. Between 2010 and 2020, the share of electricity in Total Final Consumption increased by only 0.1 %.

- From 2018 to 2021, Finland’s installed generation capacity increased from 17.6 GW to 18.7 GW. This was mostly due to growth in onshore wind generation. To accommodate the increasing share of variable energy generation, Finland is committed to improve the transmission and distribution infrastructure.

- The increase in variable renewable energy and the relatively isolated nature of Finland´s electrical grid could result in the need to curtail some electricity generation in the future. So far curtailment has been very rare, and there are no regulations in place to handle or compensate it for electricity producers.

- The IEA recommends the Finnish government to promote consumer participation in the electricity market, support demonstration projects for electrification, accelerate the integration of renewable generation into the grid, and promote energy efficiency in buildings.

- Nuclear power is a significant part of Finland’s plans for carbon neutrality, and is the largest source of electricity generation in the country. With the launch of the 1600 MW Olkiluoto 3 reactor, the share of nuclear power is expected to increase to more than 40 % of the country’s electricity generation. Olkiluoto 3 is the first nuclear reactor deployed in Europe in over 15 years, and its construction has finally been completed. The 1600 MW reactor started regular operation in April 2023.

- A third nuclear plant Hanhikivi 1 that had been under development for years was canceled in 2022. This also was a result of the Russian invasion of Ukraine, as the contractor Rosatom has close ties with the Russian government. (Fennovoima, 2022)

- While the Loviisa plant operator Fortum has a contract with the Russian TVEL for the procurement of nuclear fuel, it has been researching Western options to ensure a fuel supply for the reactors. In November 2022, Fortum announced an agreement with Westinghouse electric company for the supply of fuel for the Loviisa plant.

- The IEA sees high potential in the development of an industry around Small Modular Reactors in Finland. It urges the Finnish government to develop legislation to make SMR projects possible in the near future.

- The IEA recommends the government of Finland to strengthen public confidence in the nation’s nuclear industry, complete the update of nuclear legislation, and help to create innovation in the field of nuclear power and especially in SMRs. It also urges to secure a Western fuel supply for the Loviisa reactors.

- In May 2022 following the Russian invasion of Ukraine pipeline gas deliveries from Russia were terminated completely. This resulted in a decline of 50 % in natural gas consumption.

- A floating storage regasification unit (FSRU) was installed at the Port of Inkoo in December 2022, which will help to secure a substitute gas supply.

- Many major gas consumers reduced gas consumption or switched to alternative fuels, such as coal, biomass, and propane.

- Since May 2022 the volumes imported through the Balticconnector from Estonia have been increasing, but the capacity of the pipeline is insufficient to meet peak consumption.

- In 2020, the government launched a national biogas programme that will help reduce dependency on imported natural gas.

- The IEA recommends the Finnish government to research solutions to replace natural gas with clean or renewable alternatives, and assess the viability of the existing gas network and if needed, provide support for customers for whom it is difficult to switch to an alternative energy source.

- Between 2005 and 2021, the share of oil in the total final consumption (TFC) decreased from 34 % to 26%.

- After the Naantali refinery was closed in 2021, Finland is left with one remaining crude oil refinery in Porvoo.

- Historically Finland has imported most of its oil from Russia, but in July 2022 the main oil importer Neste stopped importing Russian oil to the country. Most of the Russian oil has successfully been replaced with imports from Norway.

- The government views biofuels as an important component in reducing oil consumption in transportation. However, to contain rising fuel prices the government reduced the biofuels blending mandate to 12 %, a significant decrease from the earlier 19.5 %.

- The IEA recommends the Finnish government to ensure the security of oil supply, and assess whether additional measures are needed to reach the targets in oil consumption reductions.

Final Thoughts

Now that all sections of the report have been dealt with, let’s go over what are the most important recommendations that this report proposes for Finland. As mentioned in the Energy Insights -section, IEA’s concerns focus on the land use sector and its aspiration to deliver the needed carbon sinks. One of the main focuses should be to prepare a contingency plan for this.

Another recommendation is to strive to continue the rapid growth of renewable energy in Finland by reducing permitting, ensuring resource availability and increasing the flexibility of the energy system. Flexibility can be increased with the development and deployment of energy storage technologies, and it will be interesting to see how and with what kind of measures Finland can tackle this challenge in the future.

Third key recommendation urges Finland to invest in the electrification of transportation and heavy industry to take full advantage of Finland’s clean electricity supply. By improving EV charging and public transport infrastructures, Finland can further support its goals of reducing oil consumption and achieve the targets set for 2030.

The final key recommendation directs to focus on critical minerals and the development of the battery industry, which Finland has already taken some steps towards. As Finland moves forward, implementing these recommendations will be key to ensuring a cleaner, more resilient, and sustainable future.

Business Finland. (2020). National Hydrogen Roadmap for Finland. Available at: https://www.businessfinland.fi/4abb35/globalassets/finnish-customers/02-build-your-network/bioeconomy–cleantech/alykas-energia/bf_national_hydrogen_roadmap_2020.pdf

European Commission. Finland’s recovery and resilience plan. Available at: https://commission.europa.eu/business-economy-euro/economic-recovery/recovery-and-resilience-facility/finlands-recovery-and-resilience-plan_en

Fennovoima (2022), Fennovoima withdraws the construction licence application for the Hanhikivi 1 nuclear power plant – focuses on maintaining the Pyhäjoki construction site, https://fennovoima.fi/2022/05/24/fennovoima-peruu-hanhikivi-1-ydinvoimalanrakentamislupahakemuksen-keskittyy-pyhajoen-tyomaan-yllapitamiseen

Fortum. (2022). The Finnish Government has published its proposal for windfall tax law – Fortum to assess the proposal | Fortum. Available at: https://www.fortum.com/media/2022/12/finnish-government-has-published-its-proposal-windfall-tax-law-fortum-assess-proposal#:%7E:text=Pursuant%20to%20the%20proposal%2C%20the,in%20the%20fiscal%20year%202023

H2cluster (2023), Industry-led hydrogen economy strategy for Finland published. Available at: https://h2cluster.fi/industry-led-hydrogen-economy-strategy-for-finland-published/

Ilmastolaki, 432/2022. Available at: https://ym.fi/documents/1410903/0/Ilmastolaki+s%C3%A4%C3%A4d%C3%B6skokoelma+(5).pdf/a495ffd2-fe82-c8fd-62d0-877ffd1fe02b/Ilmastolaki+s%C3%A4%C3%A4d%C3%B6skokoelma+(5).pdf?t=1659943761635

Ministry of Economic Affairs and Employment. (2022). Carbon neutral Finland 2035 – national climate and energy strategy. Available at: https://julkaisut.valtioneuvosto.fi/bitstream/handle/10024/164323/TEM_2022_55.pdf?sequence=4

World Bank Open Data. Available at: https://data.worldbank.org/indicator/AG.LND.FRST.ZS?contextual=aggregate&locations=FI&most_recent_value_desc=true

Leave A Comment